What Is FED OASDI/EE?

If you’ve ever taken a close look at your paycheck, you’ve likely noticed several deductions—one of which is labeled FED OASDI/EE. For many employees, this code sparks confusion. What does it stand for? Why is it deducted from your earnings? And where does this money actually go?

FED OASDI/EE stands for Federal Old-Age, Survivors, and Disability Insurance – Employee. It’s a mandatory payroll tax that funds the Social Security program in the United States. In simple terms, this deduction helps pay for retirement, disability, and survivor benefits for millions of Americans.

This article provides a comprehensive, human-friendly explanation of the FED OASDI/EE tax—covering its meaning, rate, purpose, impact on your paycheck, and how it benefits you in the long run.

What Does FED OASDI/EE Mean?

FED OASDI/EE is shorthand for:

- FED: Federal

- OASDI: Old-Age, Survivors, and Disability Insurance

- EE: Employee

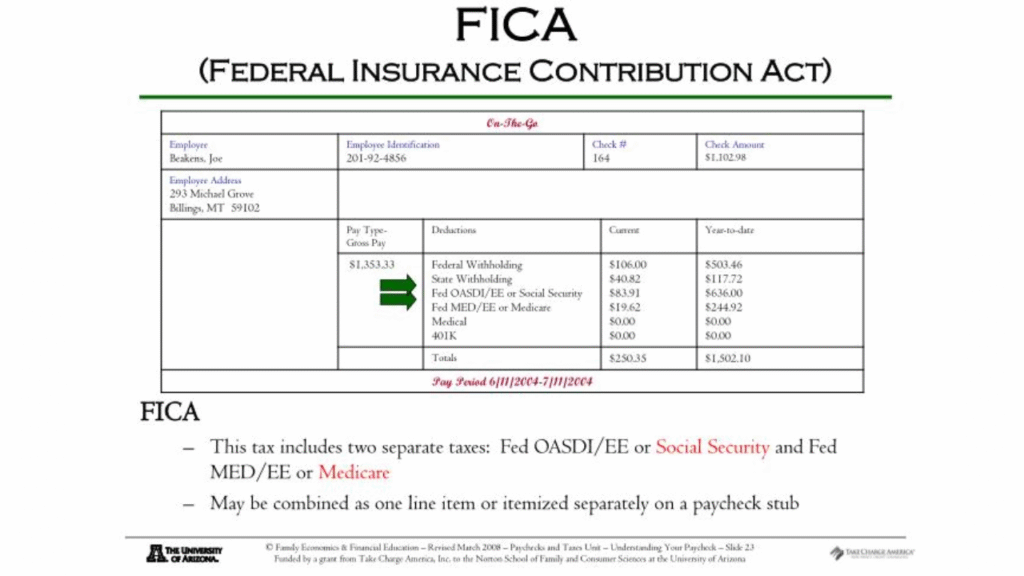

So, FED OASDI/EE literally translates to Federal Social Security tax withheld from the Employee. It’s part of the Federal Insurance Contributions Act (FICA) taxes.

The funds collected under OASDI go toward:

- Old-age benefits (retirement income)

- Survivors’ benefits (for family members of deceased workers)

- Disability insurance (for workers unable to work due to disability)

The Purpose of FED OASDI/EE

The main purpose of this tax is to fund the Social Security system, ensuring financial support for:

- Retired individuals

- Disabled workers

- Dependents and survivors of deceased workers

In short, it’s a safety net program designed to provide income when you retire, become disabled, or in the event of a breadwinner’s death.

How Much Is the FED OASDI/EE Tax Rate?

As of the latest IRS guidelines (subject to yearly updates):

- Employee OASDI rate: 6.2%

- Employer OASDI rate: 6.2%

- Total contribution: 12.4%

However, the 6.2% employee portion (FED OASDI/EE) only applies to income up to a certain limit, known as the Social Security wage base.

Example Calculation

| Annual Salary | OASDI Rate | Total OASDI Tax |

|---|---|---|

| $50,000 | 6.2% | $3,100 |

| $100,000 | 6.2% | $6,200 |

| $200,000 | 6.2% up to wage base | Varies |

The wage base limit changes each year to account for inflation. For example, if the wage base is $168,600, only earnings up to that amount are taxed for OASDI.

FED OASDI/EE vs FED MED/EE

You might also see another deduction called FED MED/EE on your paycheck. Here’s how they differ:

| Deduction Code | Meaning | Purpose | Rate |

|---|---|---|---|

| FED OASDI/EE | Social Security Tax | Funds retirement, survivor, and disability benefits | 6.2% |

| FED MED/EE | Medicare Tax | Funds healthcare for seniors and disabled persons | 1.45% |

Together, these make up your FICA taxes.

How FED OASDI/EE Appears on Your Pay Stub

Typically, your paycheck may show these deductions as:

- FED OASDI/EE – Social Security (6.2%)

- FED MED/EE – Medicare (1.45%)

These deductions are automatically calculated by your employer and sent to the Internal Revenue Service (IRS) for deposit into the Social Security Trust Fund.

Who Has to Pay the FED OASDI/EE Tax?

Almost all employees working in the United States are required to pay this tax, including:

- Full-time and part-time employees

- Temporary and seasonal workers

- U.S. citizens and resident aliens

Exceptions include:

- Certain state and local government employees

- Some religious group members with approved exemptions

- Foreign government employees working in the U.S.

How the Collected Money Is Used

Every dollar collected through the OASDI tax is distributed to:

- Retired workers: Monthly income after retirement

- Survivors: Financial support for spouses or children

- Disabled workers: Disability benefits if unable to work

It’s not a personal savings account; rather, today’s workers pay for today’s beneficiaries—a system called pay-as-you-go.

The Employer’s Contribution Explained

Employers match the employee’s OASDI contribution. For every dollar you pay, your employer contributes an equal amount to Social Security.

For example:

- You earn $1,000 in wages.

- 6.2% (or $62) is deducted from your paycheck.

- Your employer also contributes $62 on your behalf.

This shared responsibility ensures continuous funding for the Social Security system.

OASDI Tax Limits and Wage Base

The Social Security wage base is the maximum income subject to OASDI taxes each year. Earnings beyond this limit are not taxed for OASDI purposes.

| Year | Wage Base Limit | Max Employee OASDI Contribution |

|---|---|---|

| 2023 | $160,200 | $9,932.40 |

| 2024 | $168,600 | $10,459.20 |

| 2025 | TBD | — |

Historical Background of Social Security and OASDI

The Social Security Act was signed into law by President Franklin D. Roosevelt in 1935 during the Great Depression. The OASDI program was established to provide economic stability for elderly and disabled citizens.

Over time, the program expanded to include:

- Disability insurance (1956)

- Survivor benefits (1939 amendments)

The FED OASDI/EE deduction has since become one of the most vital funding mechanisms for America’s social safety net.

Can You Opt Out of FED OASDI/EE?

In most cases, no—it’s a mandatory federal tax.

However, limited exemptions exist for:

- Certain nonresident aliens

- Members of specific religious groups (with Social Security exemption approval)

- Some foreign government employees

Even if you’re exempt, opting out also means you won’t earn future Social Security benefits.

Common Misconceptions About OASDI

Myth 1: “I’ll get back exactly what I pay in.”

Not exactly. Social Security benefits are based on average lifetime earnings, not direct contributions.

Myth 2: “The government saves my money for me.”

The OASDI system works on a pay-as-you-go basis; your taxes fund current beneficiaries.

Myth 3: “Social Security will run out soon.”

While projections show strain by the 2030s, the system isn’t going away. Adjustments to rates or benefits could sustain it.

Impact of OASDI on Self-Employed Workers

If you’re self-employed, you pay both the employee and employer portions—a total of 12.4% under the Self-Employment Contributions Act (SECA).

However, you can deduct the employer-equivalent portion (6.2%) when filing your taxes to reduce taxable income.

Example:

| Income | Total OASDI Rate | Total Contribution |

|---|---|---|

| $60,000 | 12.4% | $7,440 |

FED OASDI/EE Refunds and Overpayments

If you work multiple jobs in a single year, your combined wages may exceed the Social Security wage base limit. In such cases:

- Each employer will withhold OASDI up to the limit.

- You can claim a refund for overpayment when filing your tax return using Form 1040.

Future of Social Security Funding

According to official projections, the Social Security Trust Fund faces challenges due to:

- Aging population

- Lower birth rates

- Longer life expectancy

Possible solutions include:

- Raising the wage base limit

- Increasing contribution rates

- Adjusting retirement age or benefit formulas

Despite these challenges, OASDI remains one of the most trusted social programs in the U.S.

16. How to Calculate Your FED OASDI/EE Deduction

Formula:

OASDI = (Gross Income up to Wage Base) × 6.2%

Example:

If your annual salary = $80,000,

then OASDI = $80,000 × 0.062 = $4,960

If your salary exceeds the wage base, only the first portion is taxed.

Understanding the Benefits You Earn

Your OASDI contributions translate into future benefits, including:

- Retirement benefits: Monthly income after reaching eligible retirement age

- Disability benefits: Support if you’re unable to work

- Survivor benefits: Payments to dependents or spouses after your death

These benefits are based on your lifetime earnings record and credits earned through years of work.

Frequently Asked Questions (FAQ)

Q1. What does FED OASDI/EE mean on my paycheck?

It stands for Federal Old-Age, Survivors, and Disability Insurance (Employee) — the Social Security tax deducted from your wages.

Q2. How much is the FED OASDI/EE rate?

It’s 6.2% of your earnings up to the annual Social Security wage base.

Q3. Can I stop paying FED OASDI/EE?

No, it’s a mandatory federal tax unless you qualify for specific exemptions.

Q4. Why do self-employed people pay more?

Self-employed workers cover both employee and employer shares, totaling 12.4%, under SECA.

Q5. Will I get this money back when I retire?

You’ll receive Social Security benefits based on your lifetime earnings—not necessarily a direct refund of what you paid.

Q6. What happens if I overpay OASDI?

You can claim a refund when filing your federal tax return if your combined wages exceed the wage base.

Conclusion

Understanding FED OASDI/EE is crucial for every employee. It’s not just a random deduction—it’s your contribution to a nationwide system that ensures financial stability during retirement, disability, or loss of a loved one.