Looking for a flexible loan solution but worried about your credit? Mariner Finance could be the answer. As a consumer lender specializing in personalized loans, they cater to borrowers with fair or poor credit scores, offering both secured and unsecured loan options. Whether you need funds for debt consolidation, home improvements, or unexpected expenses, Mariner Finance provides fast approvals and in-person service at local branches.

While their interest rates may be higher than traditional banks, their accessibility makes them a strong choice for those who’ve struggled with loan approvals elsewhere. Ready to explore your options? Let’s dive into how Mariner Finance works—and if it’s right for you.

Mariner Finance: company Biography

| Category | Details |

|---|---|

| company Name | Mariner Finance |

| Founded | 2002 |

| Headquarters | Baltimore, Maryland, USA |

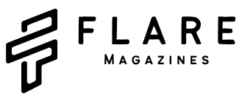

| Parent Company | Mariner Holdings (formerly part of Pacific Life) |

| Loan Types Offered | Personal Loans, Debt Consolidation, Home Improvement Loans, Secured/Unsecured Loans |

| Loan Amounts | $1,000 – $25,000 (varies by state) |

| APR Range | 16.00% – 35.99% (credit-dependent) |

| Credit Requirements | Fair to Poor Credit (Flexible Approvals) |

| Unique Features | • In-Person Branch Support • Fast Funding (Next-Day Possible) • No Prepayment Penalties |

| Availability | Operates in 30+ U.S. states (Not nationwide) |

| Customer Base | Individuals needing accessible loans, especially those with lower credit scores |

| Reputation | Mixed (Praised for accessibility, criticized for higher interest rates) |

Why This Matters

This table provides a quick snapshot of Mariner Finance’s background, helping borrowers decide if they align with the lender’s offerings. Ideal for comparisons with other personal loan providers!

What Is Mariner Finance?

Struggling with unexpected expenses or debt? Mariner Finance could be your financial lifeline. Founded in 2002, this lender specializes in personal loans for borrowers with fair or poor credit, offering both online and in-person service through its nationwide branches.

Unlike traditional banks, Mariner Finance focuses on flexible lending solutions, making it a solid option if you’ve been turned down elsewhere.

Mariner Finance Loan Options

1. Personal Loans for Any Purpose

Need funds for emergencies, vacations, or weddings? Mariner Finance provides unsecured and secured loans with fixed rates. Borrow up to $25,000 (varies by state) without collateral—or secure a lower rate by using an asset like your car.

2. Debt Consolidation Loans

Juggling multiple high-interest debts? A debt consolidation loan from Mariner Finance can merge them into one manageable payment, potentially saving you money on interest.

3. Home Improvement Financing

Planning a renovation? Whether it’s a kitchen upgrade or a roof repair, their home improvement loans help cover costs without draining savings.

How to Apply for a Mariner Finance Loan

The process is simple:

- Prequalify online (soft credit check—no score impact).

- Submit documents (proof of income, ID, etc.).

- Get approved and receive funds (sometimes as fast as the next business day).

Pro Tip: If you prefer face-to-face service, visit a local branch for personalized assistance.

Mariner Finance Interest Rates & Fees

- APR Range: 16%–35.99% (based on creditworthiness).

- Origination Fee: Varies by state.

- No Prepayment Penalty: Pay off your loan early without extra fees.

Watch Out For: Rates may be higher than banks if your credit isn’t strong. Always review the loan terms carefully.

Pros and Cons of Mariner Finance

Pros

✔ Accessible for fair/poor credit borrowers.

✔ Fast funding (next-day approval possible).

✔ No prepayment penalties.

✔ In-person support at local branches.

Cons

❌ Higher APRs than some competitors.

❌ Origination fees add to costs.

❌ Not available in all states.

Is Mariner Finance Right for You?

Good Fit If You:

- Need a loan but have less-than-perfect credit.

- Prefer personalized service (online + in-person).

- Want fast approval for emergencies.

Not Ideal If You:

- Have excellent credit (better rates elsewhere).

- Live in a state where they don’t operate.

Real-Life Example: Sarah, with a 620 credit score, got a $10,000 loan to cover medical bills when banks rejected her.

Final Verdict: Should You Choose Mariner Finance?

Mariner Finance shines for borrowers who need flexible loan options and don’t mind slightly higher rates for accessibility. If you value quick funding and personalized service, it’s worth considering.

Next Steps:

✅ Check eligibility online (soft credit pull).

✅ Compare rates with other lenders.

✅ Visit a branch if you prefer in-person help.

Ready to take control of your finances? Explore Mariner Finance loans today!