In a move that’s quietly reshaping the electric-vehicle (EV) and energy-storage landscape, Tesla’s new lithium-iron-phosphate (LFP) battery factory in Nevada marks a pivotal milestone. Located adjacent to the established Gigafactory Nevada site in Sparks, the facility is poised to bring LFP cell production on-shore in North America — unlocking cost advantages, supply-chain resilience, and a fresh chapter in battery manufacturing.

In this in-depth article we’ll explore:

- What LFP technology is, and why it matters.

- The details behind the Nevada factory: location, capacity, strategy.

- How it fits into Tesla’s broader ecosystem of energy storage, EVs, and manufacturing.

- Strategic implications: cost, supply chain, U.S. manufacturing, and more.

- Risks, challenges, and what to watch for.

- FAQs and take-aways for industry watchers, investors, and EV/energy enthusiasts.

Let’s jump in.

What Is LFP Battery Chemistry?

Understanding LFP: Lithium-Iron-Phosphate

Lithium-iron-phosphate (LFP) is a type of lithium-ion battery cathode chemistry that uses iron phosphate (FePO₄) instead of nickel, cobalt or manganese. Compared to traditional nickel-cobalt-aluminum (NCA) or nickel-manganese-cobalt (NMC) chemistries, LFP offers a unique set of trade-offs:

Key benefits of LFP:

- Uses relatively inexpensive and abundant materials (iron, phosphate) → lower raw-material cost.

- Higher thermal stability and safety profile (less prone to overheating or fire).

- Longer cycle life: better for applications where longevity matters.

- No (or very low) cobalt → avoids some of the ethical/social supply-chain concerns tied to cobalt mining.

Key trade-offs of LFP:

- Lower energy-density versus NCA/NMC: for a given weight/volume the stored energy may be less — meaning shorter range for EVs if using the same packaging.

- Consequently, some performance compromises (especially for premium EVs seeking maximum range).

- Historically more common in China and Asia; less deployed in North American vehicle battery manufacturing — the U.S. EV landscape has leaned heavier on NCA/NMC.

For EVs, LFP has increasingly been used for lower-cost models or standard-range trims (for example, in China and Europe) because of lower cost and acceptable range in those contexts.

For stationary-storage use (utility, grid, home battery packs), LFP is especially compelling because energy-density is less critical, and cost, safety and cycle-life matter more.

Why Tesla Is Embracing LFP

Tesla’s decision to build a dedicated LFP cell factory in Nevada reflects several strategic motivations:

- Cost reduction: LFP is cheaper per kWh, especially when scaled, enabling lower-cost battery packs and potentially more affordable EVs or storage products.

- Supply-chain security & on-shoring: By producing cells domestically, Tesla reduces reliance on imports (especially from China), and insulates itself from trade-tariff risks and logistical disruptions.

- Energy-storage focus: Tesla’s energy division, with products such as the Powerwall (home) and Megapack (utility-scale), can leverage LFP’s strengths (cycle life, cost) for stationary applications.

- Vehicle strategy expansion: While initial output is aimed at storage, the factory may open the door for LFP-based vehicle packs in North America — enabling lower-cost EVs or standard-range trims.

The Nevada LFP Factory – What We Know

Location and Context

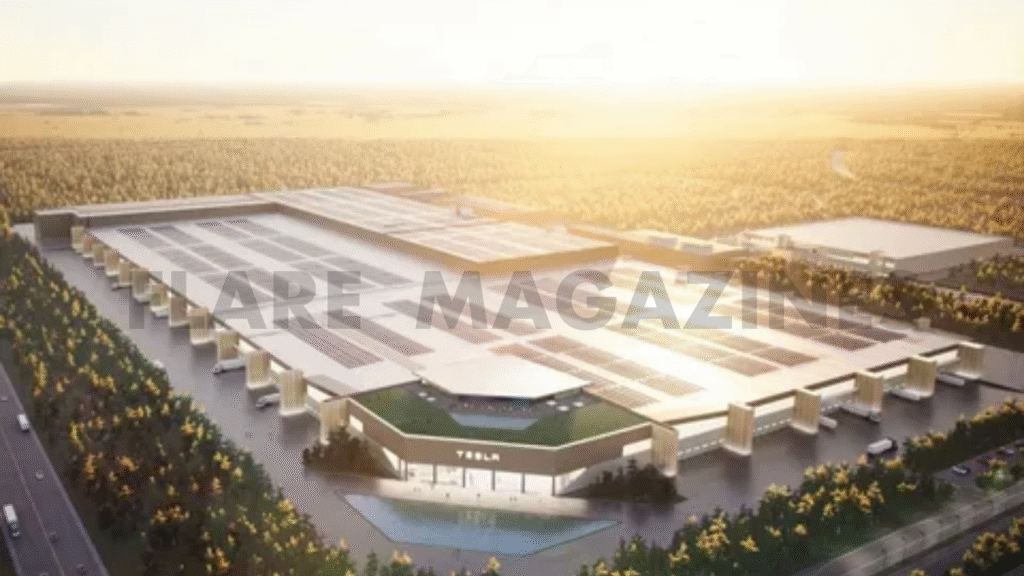

The facility is located in Sparks (Storey County), Nevada, adjacent to Tesla’s Gigafactory Nevada site at the Tahoe-Reno Industrial Center (TRIC). The linking to the existing Gigafactory campus provides synergies in logistics, infrastructure, workforce, and energy sources.

Capacity, Timeline & Equipment

- The factory is reported to have an initial 10 GWh per annum production capacity target.

- Production is nearing completion as of mid-2025; the facility is “almost ready” for production.

- The factory uses equipment purchased from the Chinese battery-manufacturer CATL (Contemporary Amperex Technology Co. Ltd). Tesla reportedly bought idle CATL machines and installs them under Tesla’s control.

- The manufacturing process reportedly uses a wet coating electrode method for LFP cells—a mature, reliable manufacturing technique.

- According to Tesla’s site: “Now we’re continuing to grow Gigafactory Nevada with a lithium iron phosphate cell factory…”

Scope & End-Use – Energy Storage First

The primary objective of the factory appears to be supplying Tesla’s energy-storage business (Powerwall, Megapack) rather than immediate vehicle use. Reports note that the cells are “primarily” intended for stationary storage.

However, the implication is this infrastructure may later support vehicle battery packs (especially LFP packs for lower-cost or standard-range models) once scaled.

Strategic Benefits for Nevada & Tesla

- Domestic manufacturing footprint: This facility enhances Tesla’s U.S. manufacturing and localizes more of the battery value-chain.

- Supply chain resilience: Reduces exposure to import pipelines, tariffs, and geopolitical risk (particularly given previous reliance on Chinese cell suppliers).

- Cost leverage & innovation: Owning cell production enables faster iteration, cost optimization and tighter quality control.

- Employment & regional impact: Likely creating jobs and boosting economic activity in Nevada’s industrial region. (While exact job counts for this segment are yet to be fully public.)

What This Means for Tesla’s Ecosystem

Energy Storage Business

Tesla’s energy division has been growing rapidly. In Q2 2025 the company deployed 9.6 GWh of energy-storage capacity, up nearly 50 % year-to-date.

With the new LFP cell factory online:

- More consistent supply of cells for Powerwall (residential) and Megapack (utility) systems.

- Potentially lower cost per kWh of storage, making grid-scale and distributed storage more competitive.

- Faster lead times and logistics because of on-site cell production.

Vehicle Battery Strategy

While the factory is initially storage-focused, the longer-term vehicle implications are significant:

- Tesla already uses LFP‐based packs for some models in China and Europe.

- Domestic LFP production may allow Tesla to offer more affordable entry-level models in North America (or bring back LFP packs which had been less prevalent).

- Lower battery cost enables smaller margins or lower price points, which can spur greater EV adoption.

Manufacturing & Vertical Integration

Tesla has repeatedly emphasised its strategy of vertical integration (making more of its components in-house). The LFP factory aligns with that:

- Owning the full stack (cell, pack, integration) in the U.S. rather than outsourcing completely.

- More control over manufacturing process and timeline.

- Ability to innovate (e.g., electrode coating processes) and adopt manufacturing advancements faster.

Regulatory & Incentive Benefits

Building cell production in the U.S. helps Tesla tap into U.S. incentives:

- Tax credits requiring domestic content (for EV battery cells and manufacturing) mean U.S. content helps eligibility.

- Reduces exposure to import tariffs or supply-chain disruptions flagged by regulators.

Strategic Implications & Market Impact

For the Battery Industry

- Tesla’s move signals that LFP chemistry is becoming more mainstream in North America—not just as an alternative but a core strategy.

- Other automakers and battery-makers may scale their own LFP production in response, potentially accelerating cost declines across the market.

- Closer to U.S. battery self-reliance, less dependence on foreign cell production.

For EV Consumers

- Potential for lower-cost EVs: If battery cost drops, that saving can trickle into lower vehicle prices.

- Improved access to EVs for more segments of the market.

- For existing Tesla owners, more availability of lower-cost or standard-range models.

For Energy Storage and Clean-Tech

- Higher domestic production of storage cells means faster deployment of grid-scale battery storage solutions — enabling greater renewable integration, grid stability, and resilience.

- Stationary storage becomes more cost-competitive with traditional fossil-fuel or peaker-plant solutions.

For U.S. Manufacturing & Economy

- The factory highlights U.S. investment in advanced manufacturing, high-tech supply chains, and clean-energy infrastructure.

- Nevada benefits from job creation, industrial growth, and regional economic development.

What to Watch: Risks & Questions

| Challenge | What to Monitor | Why It Matters |

|---|---|---|

| Scale & ramp-up | Tesla delays or slower capacity ramp-up beyond 10 GWh | If ramp is slow, cost advantages may be delayed |

| Chemistry trade-offs | LFP’s lower energy density vs NCA/NMC | Important for EVs where range is competitive driver |

| Cell cost convergence | Whether Tesla can reduce per-kWh cost to targeted levels | Determines how much of the savings can be passed on |

| Supply-chain for materials | Iron phosphate, lithium, manufacturing equipment | Bottlenecks may emerge even for LFP |

| Vehicle usage | Whether Tesla uses Nevada LFP cells for vehicles, and when | Critical for full strategy of more affordable EVs |

| Competition & market shifts | Other battery chemistries (solid-state, etc) emerging | LFP may face disruption in longer term |

Frequently Asked Questions (FAQ)

Q1: What exactly is the Tesla LFP battery factory in Nevada producing?

The facility is designed to produce lithium-iron-phosphate (LFP) battery cells. Initially, the output will likely feed into Tesla’s stationary-storage products (Powerwall for homes, Megapack for utilities).

Over time the factory may support vehicle battery packs too, particularly for lower-cost or standard-range EV models — but that is not the immediate main use case.

Q2: Why did Tesla choose Nevada for this factory?

Several reasons:

- Proximity to its existing Gigafactory Nevada campus (shared infrastructure, workforce, logistics).

- Nevada offers industrial incentives, and a favorable business/energy environment.

- On-shoring battery cell production helps Tesla achieve regulatory goals (domestic manufacturing, tax-credit eligibility).

- The Tahoe-Reno Industrial Center (TRIC) is a well-established industrial zone suited for high-volume manufacturing.

Q3: What is the capacity of the factory?

Initial reported capacity is about 10 GWh per year of LFP cell production. As Tesla ramps up, that figure may grow over time depending on market demand and internal strategy.

Q4: How does LFP differ from Tesla’s existing battery chemistries?

- Established Tesla packs have used chemistries such as nickel-cobalt-aluminum (NCA) or nickel-manganese-cobalt (NMC), which have higher energy densities (good for range) but also higher cost, more complex material sourcing, and safety/thermal-stability trade-offs.

- LFP sacrifices some energy density (so range may be lower for the same pack size) but gains cost-savings, safety, longevity, and less reliance on critical minerals like cobalt.

- Therefore, LFP is especially suited for stationary-storage or entry/standard-range EVs where ultra-long range is less critical.

Q5: Will Tesla use the LFP cells from Nevada factory in its EVs in the U.S.?

It’s plausible, but not guaranteed in the short term. Reports suggest initially the cells will serve storage products. However, the factory sets the stage for Tesla to offer LFP-based battery packs in U.S. vehicles in the future, potentially lowering cost and enabling more affordable EV models.

If Tesla does move LFP cell output into vehicle packs in North America, that could be a game-changer for the cost of entry-level EVs.

Q6: What are the advantages for Tesla’s energy-storage business?

- Lower cost per kWh for storage systems → better margin or more competitive pricing for Powerwall/Megapack.

- Shorter supply-chain routes (domestic production) → faster lead times, less shipping/import cost, fewer disruptions.

- Increased scale of production (with 10 GWh+ capacity) helps meet rising demand for grid-scale storage, renewable integration, and home energy systems.

- Enhanced vertical-control: Tesla can own more of the process rather than rely on external cell-suppliers alone.

Q7: What are the potential challenges or risks?

- Scaling from initial capacity to full-scale production takes time; ramp-up issues can delay benefits.

- LFP’s lower energy density may limit its suitability for high-range premium EVs versus NCA/NMC chemistries.

- Raw-material or manufacturing-equipment bottlenecks may still emerge (though LFP avoids some materials like cobalt, it still needs lithium, phosphate, etc).

- Competing battery chemistries (solid-state, advanced NMC, etc) may reduce the long-term advantage of LFP.

- Execution risk: manufacturing cell culture, quality control, economies of scale all matter.

Example: How This Might Look in Practice

Imagine the following scenario:

- Tesla is producing LFP cells at its Nevada factory, supplying the next generation of the Powerwall. With cheaper cells, the cost per kWh of the home storage solution drops by, say, 10-15 %. That savings allows Tesla to offer the product at a slightly lower price or maintain price while increasing margin.

- On the EV side: Suppose Tesla introduces a new Standard-Range Model Y in North America featuring LFP cells produced in Nevada. Because of domestic production, Tesla avoids import tariffs and benefits from U.S. content-incentives. The car’s battery-pack cost is lowered, enabling a base price drop of, say, $2000 – $3000 relative to previous models — making it more accessible to a broader market.

- On the utility side: A large utility signs a contract for 500 MWh of Megapack installations in a region integrating high levels of solar and wind. With locally-produced LFP cells, Tesla can promise shorter delivery lead-times and more competitive pricing — enabling faster grid-scale storage deployment, helping that region stabilize its grid.

These are hypothetical, but illustrate the ripple-effects of cell-level manufacturing.

Conclusion

The “Tesla LFP battery factory Nevada” is a strategic linchpin in Tesla’s evolution — shifting from dependence on external cell-suppliers and overseas manufacturing, toward a more vertically-integrated, domestic, and cost-competitive model. It reinforces Tesla’s positioning not only as an EV manufacturer but as a full-stack energy-company: producing batteries, energy-storage systems, and vehicles.